Actionable Tips on Buying Into an Existing Business as a Partner

Are you considering the leap from employee to business partner?

Or are you contemplating buying into a mature business as an outsider?

Buying into an existing business can be a pivotal moment and potentially lucrative opportunity, but it's not a decision to take lightly.

Today, we're discussing key considerations, potential pitfalls, and actionable tips to help you navigate the complex process of becoming a partner in an established company.

Unlike starting a new venture from scratch, buying into a mature business has unique nuances. You're stepping into an operation with a proven track record, existing customers, and established processes. However, it also comes with its own set of challenges and complexities that require careful consideration.

In this article, we'll explore the intricacies of business partnerships, dive into the critical aspects of evaluating cash flow, and unpack the essential elements of partnership agreements. Whether you're a seasoned entrepreneur or a first-time business owner, my goal is to equip you with the knowledge to make informed decisions and set yourself up for success in your new role as a partner.

Table of Contents

Understanding Business Partnerships

What Does It Mean to Buy into a Partnership?

Differences Between Buying in as a Partner vs. Buying the Whole Business

10 Actionable Tips for Navigating Partnerships

Get Your Free Buy-Side Transaction Starter Guide

10 Actionable Tips for Evaluating Finances

Partnership Agreement: Your Business Prenup

Key Elements of a Partnership Agreement

6. Partnership Equities and Liabilities

10 Actionable Tips When Reviewing an Existing Partnership Agreement

How to buy into a company as a partner?

How do I bring a partner into an existing business?

Understanding Business Partnerships

What is a Partnership?

A business partnership is a legal arrangement in which two or more individuals or entities collaborate to run a business and share its profits and losses. It's kinda like a marriage for your professional life – you're committing to work towards common goals, share responsibilities, and navigate challenges as a team.

Partnerships can take various forms, each with its own legal and financial implications:

General Partnership: All business partners have equal say and liability.

Limited Partnership: Some partners have more control and liability than others.

Limited Liability Partnership (LLP): Partners have some protection from personal liability.

Understanding these structures is crucial when considering buying into an existing business.

Risks of Partnerships

While partnerships can be rewarding, they're not without risks. Potential pitfalls include:

Conflicts over decision-making: Disagreements on business direction can lead to deadlocks.

Unequal contribution of time or resources: This can breed resentment among partners.

Financial disagreements: Disputes over profit distribution or financial management can strain relationships.

Liability for your partner's actions: In some business partnership structures, you could be personally liable for your partner's business decisions.

Challenges in exiting the partnership: Leaving the partnership can be complicated and costly without a clear exit strategy.

What Does It Mean to Buy into a Partnership?

Buying into a partnership means purchasing a stake in an existing business and becoming a co-owner alongside current partners. This differs from buying the entire business outright or starting a new business partnership from scratch. When you buy in, you're joining an existing team, sharing in both the rewards and the responsibilities of running the company.

Differences Between Buying in as a Partner vs. Buying the Whole Business

When you buy into a partnership, you're:

Joining an existing team and culture: You'll need to adapt to established ways of doing business.

Sharing decision-making power: Major decisions will require consensus among partners.

Potentially benefiting from established systems and clientele: You're not starting from zero.

Sharing both profits and losses: Your financial stake is tied to the business's overall performance.

In contrast, buying the whole business means:

Full control over decisions: You have the final say in all business matters, especially your remuneration.

Sole responsibility for success or failure: The business's performance rests entirely on your shoulders.

Potentially more freedom to make changes: You can overhaul systems and strategies as you see fit.

Keeping all profits (but also bearing all losses): The financial rewards and risks are yours alone.

Shared Goals and Values

One critical aspect of a successful partnership is alignment on goals and values. Before buying in, have open and honest discussions with existing partners about:

The company's long-term vision: Where do you see the business in 5, 10, or 20 years?

Growth strategies: Are you aiming for rapid expansion or steady, sustainable growth?

Risk tolerance: How comfortable are you and your partners with taking financial or strategic risks?

Work-life balance expectations: What level of time commitment is expected from each partner?

Exit strategies: How do you envision eventually transitioning out of the business?

10 Actionable Tips for Navigating Partnerships

Conduct thorough due diligence on the existing business: Understand its financial health, market position, and potential risks.

Have frank discussions about roles and responsibilities: Clarity on who does what can prevent future conflicts.

Ensure your skills complement those of other partners: Diversity in expertise can strengthen the partnership.

Discuss how conflicts will be resolved: Establish a process for handling disagreements before they arise.

Agree on a clear decision-making process: Determine how major business decisions will be made.

Set realistic expectations for time commitment: Be clear about the level of involvement expected from each partner.

Establish a system for regular communication: Regular partner meetings can keep everyone aligned.

Discuss plans for future growth and expansion: Ensure all partners are on the same page about the business's direction.

Consider a trial period before fully committing: This can give you a chance to see if the partnership is a good fit.

Consult with a lawyer experienced in business partnerships: Professional legal advice can help you navigate complex partnership agreements.

Get Your Free Buy-Side Transaction Starter Guide

If you're ready to dive deeper into the process of buying into a business, download our Ultimate Buy-Side Transaction Starter Guide.

Grab the checklist with all the questions to ask when buying a biz in this free guide, Ultimate Buy-Side Transaction Starter Guide. You'll get:

The complete list of everything to request in due diligence,

A checklist of the essential questions to ask before buying a business, and

The essential questions to ask when buying a business.

Download your Ultimate Buy-Side Transaction Starter Guide here.

Evaluating Cash Flow

When buying into an existing business, understanding its financial health is critical. This involves a deep dive into:

Historical financial statements: Review at least 3-5 years of past financial performance.

Cash flow projections: Understand the business's expected future financial performance.

Debt obligations: Know what financial commitments the business has.

Asset valuation: Understand what the business owns and its worth.

Customer and supplier relationships: Evaluate the stability of key business relationships.

Pay special attention to the business's cash flow.

A business might show profits on paper but still struggle if it cannot manage its cash effectively. You’ll also want to assess how the projected cash flow will change (if at all) when you become a partner. Will top-line revenue increase? Will increased remuneration to you decrease the profits available to be split?

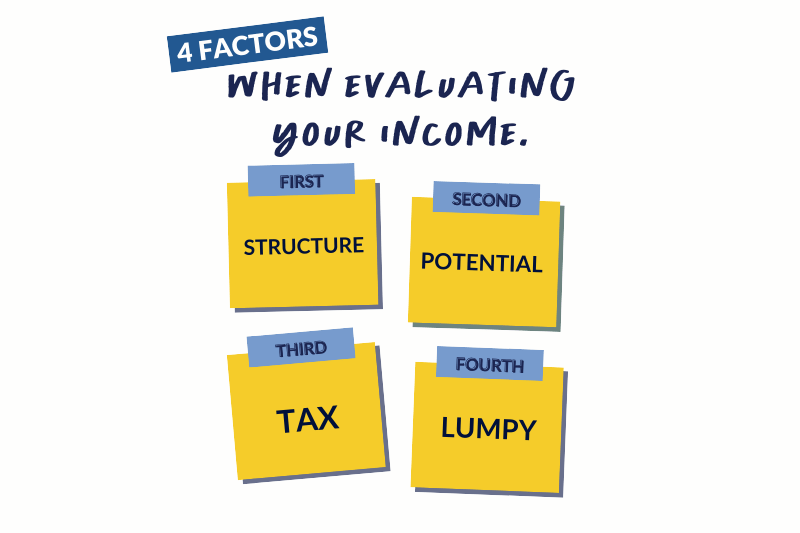

From Employee to Partner: Evaluating Your Income

If you're transitioning from employee to partner in the same business, it's essential to understand how your income will change. As an employee, you likely received a regular salary. As a partner, your income may be more variable, tied to the business's performance.

Consider:

How partner compensation is structured: Will you receive a base salary plus profit share, or will all your income be tied to business performance?

The potential for increased earnings: While your income may be less stable, the upside potential could be significant.

Your new tax obligations as an owner: Partnership income is often treated differently for tax purposes than employee income.

The impact on your personal financial planning: You may need to adjust your budgeting and financial strategies to account for more variable income.

Once you’ve projected your future potential income, compare it to what you get now. If you already work full-time at the business and will be working full-time as a partner, the incremental cash flow is your “return on investment.”

10 Actionable Tips for Evaluating Finances

Review at least three years of financial statements: Look for trends and patterns in the business's financial performance.

Analyze seasonal fluctuations in revenue: Understanding these patterns can help you plan for cash management.

Understand the business's billing and collection practices: These can significantly impact cash flow.

Evaluate the company's debt service obligations: Know what financial commitments the business has to meet.

Consider the impact of upcoming capital expenditures: Major purchases or investments can affect short-term cash.

Assess the stability of key customer relationships: Are there any clients the business is overly reliant on?

Understand the business's break-even point: Know at what point the business starts making a profit.

Review the company's cash management practices: Effective cash management is crucial for business success.

Consider potential impacts of industry trends on future income: How might changes in your industry affect the business?

Consult with a financial advisor to interpret the numbers: A professional can help you understand the implications of the financial data.

Partnership Agreement: Your Business Prenup

A well-crafted partnership agreement is crucial when buying into an existing business. It's kinda like a prenuptial agreement for your business relationship, setting clear expectations and guidelines for how the partnership will operate.

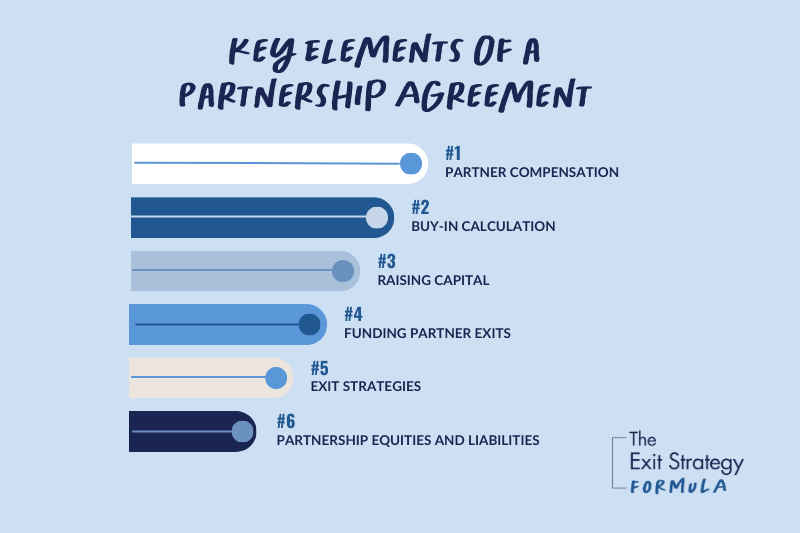

Key Elements of a Partnership Agreement

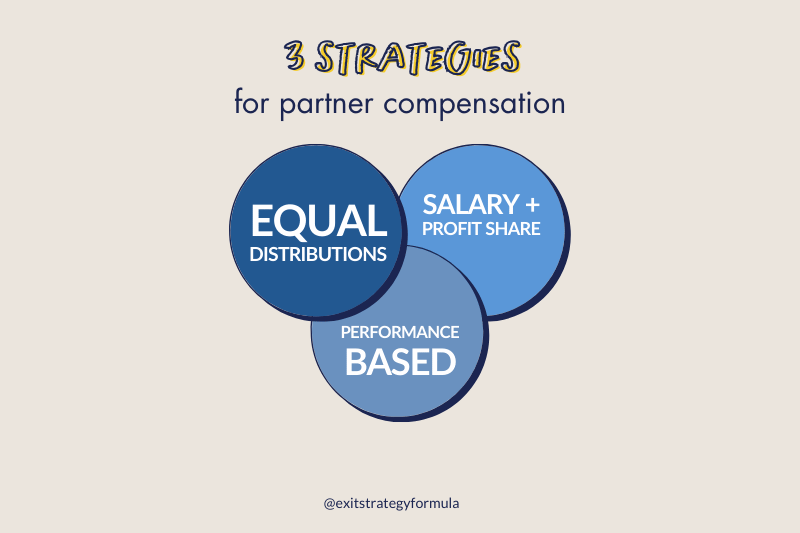

1. Partner Compensation

How partners are paid can vary widely between businesses. Common methods include:

Equal distribution of profits

Salary plus profit share

Performance-based compensation

The agreement should clearly outline how and when partners will be compensated, including provisions for reinvesting profits back into the business.

2. Buy-In Calculation

The agreement should detail how your buy-in amount is calculated. This might be based on:

Book value of the business

Fair market value

A multiple of earnings

A combination of methods

It's important to understand and agree on the valuation method and value, before proceeding with the partnership. For the one formula you need to know to do this and the insider strategies to negotiate the best price, check out my program, The Valuation Formula.

3. Raising Capital

If the business needs additional capital in the future, the agreement should specify:

How decisions to raise capital are made

Partners' obligations to contribute

Consequences of not contributing

Options for bringing in outside investors

4. Funding Partner Exits

Planning for partner exits is crucial. The agreement should cover:

How a departing partner's share is valued

Funding mechanisms for buyouts (e.g., insurance policies, sinking funds)

Timeframes for payouts

Restrictions on selling partnership shares to outside parties

5. Exit Strategies

The agreement should address various exit scenarios, including:

Total sale of the business

One partner wanting to leave

Forced exits due to poor performance or ethical breaches

Retirement of a partner

Death or incapacitation of a partner

6. Partnership Equities and Liabilities

Clear guidelines on how assets, debts, and liabilities are shared among partners are essential. This should include:

How profits and losses are allocated

Responsibility for business debts

Ownership of intellectual property

Use of company assets

Financing Your Buy-In

There are several options for financing your partnership buy-in:

Personal savings: Using your own funds gives you the most control but may deplete your personal resources.

Bank loans: Traditional bank financing may be available, often requiring collateral.

Seller financing: The existing partners may be willing to finance part of your buy-in.

SBA loans: Small Business Administration loans can offer favorable terms for business acquisitions.

Equity investors: Bringing in outside investors can provide capital but may dilute your ownership.

Each option has its pros and cons, so carefully consider which is best for your situation. Don't hesitate to consult with a financial advisor to understand the implications of each financing method.

Legal Considerations

Always consult with a lawyer experienced in business partnerships before signing any agreements. They can help you navigate:

Tax implications of different partnership structures

Liability protections

Intellectual property rights

Non-compete clauses

Regulatory compliance in your industry

Remember, it's much easier to address potential issues upfront in your partnership agreement than to resolve disputes later.

When buying into an existing business, it's crucial to understand the current business structure and consider whether it needs to change. Many small businesses start as a sole proprietorship or an S corporation due to their simplicity and tax advantages. However, as you transition from being an employee to a partner, you may need to reassess the business structure. For instance:

A sole proprietorship will need to be converted to a partnership or another entity type.

An S corporation has restrictions on the number and type of shareholders it can have, which could impact your ability to buy in.

Carefully evaluate the pros and cons of different business structures with your potential partners and a qualified tax advisor to ensure you choose the option that best suits the evolving needs of the business and its owners.

10 Actionable Tips When Reviewing an Existing Partnership Agreement

Thoroughly review the existing partnership agreement – it's your roadmap for understanding the business relationship you're entering.

Ensure roles and responsibilities for each partner, including your proposed role, are clearly defined to avoid future confusion.

Check for a dispute resolution process. If it's not included, negotiate to add one before buying in.

Understand the process for admitting new partners. This is how you're being brought in and could affect future ownership changes.

Examine how profits and losses are allocated among partners. Ensure you're comfortable with how this will apply to you.

Look for provisions about regular financial reporting and partner meetings. These are crucial for staying informed about the business.

Review the process for making major business decisions. Understand how much say you'll have as a new partner.

Check what happens if a partner becomes disabled or dies. Ensure there's a clear succession plan.

Carefully review the buy-sell agreement. This will dictate how you can exit the partnership in the future if needed.

Propose a regular review and update process for the agreement if one doesn't exist. Business needs evolve, and the agreement should too.

Remember, don't hesitate to negotiate changes to the existing agreement as part of your buy-in process. Your entry into the business is an opportunity to revisit and improve the partnership agreement for everyone involved.

Frequently Asked Questions

How to buy into a company as a partner?

Buying into a company as a partner typically involves these steps:

Conduct thorough due diligence on the business

Negotiate your ownership percentage and buy-in price

Secure financing for your buy-in

Draft and sign a comprehensive partnership agreement

Complete the legal transfer of ownership

Integrate into your new role as a partner

How do I bring a partner into an existing business?

To bring a new partner into your existing business:

Clearly define why you want a new partner and what they'll bring to the business

Determine how much ownership you're willing to sell

Value your business to set a fair buy-in price

Vet potential partners thoroughly

Negotiate terms of the partnership

Update or create a comprehensive partnership agreement

Complete the legal and financial aspects of the ownership transfer

What does it mean to buy in as a partner?

Buying in as a partner means purchasing a portion of ownership in an existing business. This typically involves:

Investing capital into the business

Becoming a co-owner with existing partners

Sharing in the profits and losses of the business

Taking on management responsibilities

Having a say in business decisions

What is it called when someone buys an existing business?

When someone buys an existing business, it's typically referred to as:

Business acquisition

Buying a going concern

Purchasing an established business

If they're buying only a portion of the business to become a partner, it might be called:

Buying into a partnership

Acquiring a partnership stake

Becoming an equity partner

Next Steps

Ready to take the next step in your journey to business ownership? Whether you're seriously considering buying into a partnership or just starting to explore your options, we've got resources to help you make informed decisions.

Get Your Free Buy-Side Transaction Starter Guide

If you're ready to dive deeper into the process of buying into a business, download our Ultimate Buy-Side Transaction Starter Guide.

Grab the checklist with all the questions to ask when buying a biz in this free guide, Ultimate Buy-Side Transaction Starter Guide. You'll get:

The complete list of everything to request in due diligence,

A checklist of the essential questions to ask before buying a business, and

The essential questions to ask when buying a business.

Download your Ultimate Buy-Side Transaction Starter Guide here.