5 Ways to Get a Business Appraisal Valuation

Understanding your company's true value is crucial as a business owner, whether you're planning to sell, seeking investors, or simply want to gauge your financial position. This is where a business appraisal valuation comes in. A business valuation appraisal (or appraisal for short) is a comprehensive assessment of your company's worth, taking into account various factors such as financial statements, market conditions, and intangible assets.

Table of Contents

What is a business valuation, and why do you need one?

Understanding Business Valuations

Common Business Valuation Methods:

The 5 ways to get a Business Appraisal Valuation

Hire a business broker to sell your business

Use an online calculator or software tool

Hire a professional business valuator

What is a business valuation, and why do you need one?

But why do you need a business appraisal valuation? Simply put, it provides clarity and confidence. Whether you're negotiating a sale, establishing buy-sell agreements, or making strategic decisions, knowing your business's fair market value is essential. It's not just about numbers; it's about understanding your company's potential and positioning yourself for success.

Understanding Business Valuations

A business valuation is the process of determining a company's economic value. It's crucial for business owners, investors, and financial professionals to make decisions about buying, selling, or investing in a business.

Key Components

Financial Analysis: Examining financial statements to assess the company's health and performance.

Market Analysis: Understanding industry trends and economic factors affecting the business.

Asset Valuation: Assessing both tangible and intangible assets.

Future Earnings Potential: Projecting the business's ability to generate future profits.

Common Business Valuation Methods:

Market Approach: Comparing the business to similar companies recently sold.

Income Approach: Focusing on expected future income, often using the Discounted Cash Flow method.

Asset Approach: Calculating the value of all assets minus liabilities.

Reasons For Valuations:

Selling or buying a business

Attracting investors

Strategic planning

Legal and tax purposes

Setting up Employee Stock Ownership Plans

Small Business Challenges:

Subjectivity in judgment

Rapidly changing market conditions

Difficulty in valuing intangible assets

Complexities specific to small businesses

Understanding these aspects of business valuation equips you to navigate the process more effectively. Whether you're conducting a DIY valuation or working with a professional, remember that a thorough valuation provides more than just a number. It offers valuable insights into your company's strengths, weaknesses, and growth potential.

For a deeper dive into valuation strategies and how to maximize your business's worth, consider joining our Valuation Formula program. It's designed to empower business owners like you with the knowledge and tools to confidently assess and increase your company's value.

In this article, we'll explore five effective ways to get a valuation. Each method has its pros and cons, and the best choice depends on your specific needs, budget, and circumstances. Let's dive in and discover which approach might be right for you.

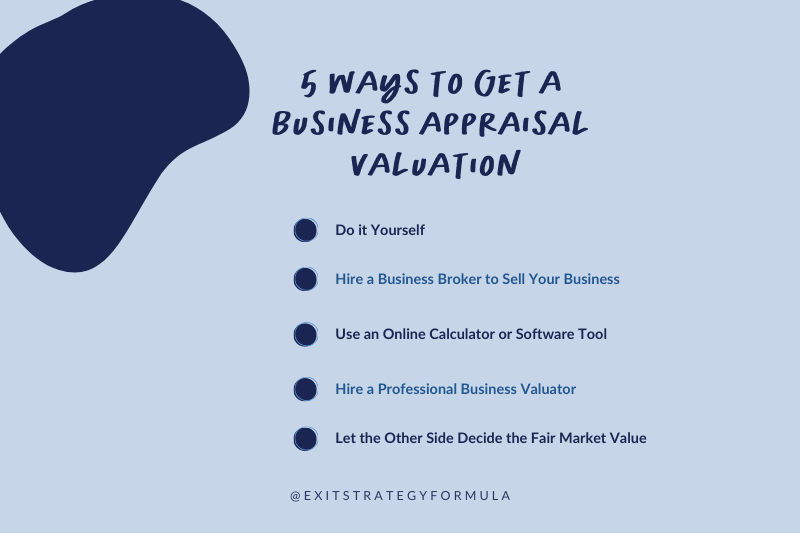

The 5 ways to get a Business Appraisal Valuation

Do it Yourself

For the hands-on entrepreneur, conducting your own business valuation can be an enlightening experience. This approach involves using various business valuation methods to estimate your company's worth. While it requires time and effort, it can provide valuable insights into your business's financial health.

Pros:

Cost-effective

Deepens your understanding of your business's financials

Flexibility to adjust valuation as needed

Cons:

Potential for bias or inaccuracy

Time-consuming

May lack credibility with external parties

To conduct your own assessment, start by gathering all relevant financial statements. Then, research different valuation methods such as the asset approach, market approach, and income approach. The discounted cash flow method, for instance, is a popular choice for estimating future cash flows.

Remember, while a DIY approach can be informative, it may not hold up in formal situations like securing loans or negotiating with potential buyers.

Hire a business broker to sell your business

Hiring a business broker can be an excellent option if you're specifically looking to sell your business. These professionals not only provide an assessment but also help navigate the entire sales process.

Pros:

Expertise in business valuation and sales

Access to a network of potential buyers

Handles negotiations and paperwork

Cons:

It can be expensive (typically a percentage of the sale price)

It may not be as thorough as a certified business valuation appraisal

Potential conflict of interest (higher valuation = higher commission)

Business brokers use their experience and market knowledge to determine a fair market value for your business. They consider factors like industry trends, comparable sales, and your specific business metrics to arrive at a valuation.

Use an online calculator or software tool

In our digital age, numerous online tools and software programs are designed to provide quick business valuations. These can range from simple calculators to sophisticated programs considering multiple factors.

While online tools can provide a rough estimated business value, they shouldn't be relied upon for major decisions. They're best used as a starting point or for periodic check-ins on your business's value. To get started with a basic valuation range for your company, try our free business valuation calculator. It considers key factors like revenue, profitability, and industry standards to provide an initial estimate.

Pros:

Quick and easy

Often free or low-cost

Provides a ballpark figure

Cons:

May oversimplify complex business situations

Accuracy can vary widely

It doesn't account for unique aspects of your business

While online tools can provide a rough estimated business valuation, they shouldn't be relied upon for major decisions. They're best used as a starting point or for periodic check-ins on your business's value.

Hire a professional business valuator

For the most comprehensive and credible business valuations, hiring a professional business valuator or a certified valuation analyst is often the best choice. These experts specialize in determining the fair market value of businesses across various industries.

Pros:

A highly accurate and thorough valuation

Credibility with banks, investors, and potential buyers

Considers all aspects of your business, including intangible assets

Can provide valuable insights for improving business value

Cons:

Most expensive option

It can take several weeks to complete

Professional business appraisers use a combination of valuation methods to arrive at a fair market value. They'll analyze your financial statements, assess market conditions, and consider factors unique to your business. This approach is particularly valuable for complex situations, such as when dealing with significant intangible assets or in industries with specific valuation norms.

Let the other side decide the fair market value

In some cases, the other party may conduct their own business appraisal, particularly in business sales or disputes. While this isn't a method you can initiate yourself, it's essential to be prepared for this scenario.

Pros:

No cost to you

Can provide a different perspective on your business's value

Cons:

You may undervalue your business

You have less control over the process

Potential for disagreements over valuation

In these situations, it's crucial to have a solid understanding of your business's value beforehand. This allows you to negotiate and challenge any undervaluations effectively. Consider having your own business appraisal done as a counterpoint.

Frequently Asked Questions

How often should I get a certified business appraisal?

It's generally recommended that businesses get appraisals every 2-3 years or whenever significant changes occur in their operations or industries.

What factors affect my business's value?

Key factors include financial performance, market conditions, industry trends, assets (both tangible and intangible), and future growth potential.

How long do business appraisals take?

The timeline can vary widely. A DIY valuation might take a few days, while a professional business appraisal could take several weeks.

Are business appraisals expensive?

Costs can range from free (for some online tools) to several thousand dollars for a comprehensive professional appraisal. The investment is often worthwhile for the insights and credibility it provides.

Next Steps

Understanding your business's value is a crucial skill for any business owner. While professional appraisals have their place, they come with significant drawbacks:

High costs: Professional valuations can be expensive, especially if you need them regularly.

Lack of flexibility: When business circumstances change, you can't quickly adjust a professional valuation.

Limited understanding: If you can't explain or defend your business's value, you're at a disadvantage in negotiations.

Dependency: Relying solely on others for valuation leaves you vulnerable in critical business discussions.

That's why it's essential to learn how to value your business yourself. By mastering this skill, you'll:

Save money on frequent professional appraisals

Adapt quickly to changing business conditions

Confidently discuss your business's value with potential buyers or investors

Make informed decisions about your company's future

Ready to take control of your business's valuation? Consider enrolling in The Valuation Formula program. This comprehensive guide walks you through the process of valuing your business, helping you understand the key drivers of value and how to maximize your company's worth.

Don't leave your business's value to chance or solely in the hands of others. Empower yourself with the knowledge to assess and articulate your company's worth accurately. Sign up for our free masterclass to learn more about how you can confidently value your business and negotiate the best price when the time comes to sell.

Remember, in the world of business, knowledge truly is power. By understanding your business's value inside and out, you'll be better equipped to make strategic decisions, attract investors, and ultimately achieve your entrepreneurial goals. Take the first step towards mastering business valuation today.