7 Steps to Plan Your Business Exit Strategy

Maximize Your Value and Secure Your Future

Introduction: Why Every Business Owner Needs an Exit Strategy

As a business owner, you've poured your heart and soul into building your company. But have you thought about your endgame? That's where a business exit strategy comes in. Kinda like a GPS for your entrepreneurial journey, an exit strategy is your roadmap to successfully transitioning out of your business when the time comes.

Whether you're dreaming of retiring on a beach, starting a new venture, or simply want to be prepared for any scenario, having a solid exit strategy is crucial. It's not just about planning for the future – it's about maximizing the value and ensuring all your hard work pays off.

Step 1: Defining Your Business Exit Strategy Goals

The first step in crafting your exit strategy is to get crystal clear on what you want. Are you looking to cash out completely? Pass the torch to a family member? Or maybe you want to remain involved in some capacity?

Your personal goals should drive your exit strategy. Maybe you want to sell your business to secure your retirement nest egg, fund world travels, or start your next big idea.

Whatever your dreams, aligning your personal aspirations with your business objectives is key. This alignment will shape every decision you make in your exit planning process.

Why? Your level of involvement in the business the day after, 6 months after, and years after a sale changes the terms of a transaction.

Step 2: Assessing Your Current Business Value and Operations

Before you can plan your exit, you need to know where you're starting from. This means taking a hard look at your current business's value and operations.

Understanding the key drivers of value in your specific business and your specific industry is crucial. Is it your cash flow? Your customer base? Your intellectual property? Why would a buyer want your specific business? Identifying these factors will help you focus your efforts where they'll have the biggest impact.

Next, evaluate your business operations. Are your processes efficient? Is your financial information in order? Are there any weak spots that could turn off potential buyers? This assessment will help you identify areas for improvement and give you a realistic picture of your business's worth.

Step 3: Exploring Exit Strategies for Your Business

Now that you know where you stand, it's time to explore your options. There are several common exit strategies to consider:

Selling to a third party: This could be a competitor, a larger company in your industry, or even private investors.

Family succession: Passing the business on to a family member can be a great way to preserve your legacy.

Management buyout: Selling to your existing management team can ensure continuity for your employees and clients.

Initial public offering (IPO): For some businesses, going public might be the best strategy.

Liquidation: While not ideal, sometimes selling off assets is the most practical option.

Each of these exit strategies has its pros and cons. For instance, selling to a third party might maximize profits but could lead to significant changes in the business. On the other hand, a management buyout or family succession might preserve your company culture but could potentially yield a lower purchase price.

The best exit strategy for you will depend on your personal goals (see Step 1), your business type (see Step 2), and market conditions.

Step 4: Enhancing Your Business Value Through Improved Operations

Once you've settled on your preferred exit strategy, before you go to sell, it's time to roll up your sleeves and boost your business's value. This often means focusing on improving your business operations.

Start by streamlining your processes. Efficient operations not only increase profitability but also make your business more attractive to potential buyers. Implement systems that can run without your constant involvement – this shows that the business isn't entirely dependent on you.

Next, focus on your financials. Clean, organized financial records are crucial for any exit. They provide a clear picture of your business's health and potential, which can help you negotiate a better deal when it's time to exit.

Don't forget about your team. Skilled employees are a valuable asset. Investing in your staff's development can significantly increase the value.

Also, review your employment agreements. Are they favorable for a potential buyer?

Step 5: Building a Strong Management Team for Your Exit Strategy

Speaking of teams, a strong management team is crucial for a successful exit. Why? Because it shows that your business can survive/thrive without you at the helm.

Start by identifying key roles that you perform in your company. Then, either develop existing staff to fulfill these responsibilities or hire skilled employees who can take on these sales or leadership responsibilities.

Implement succession planning for critical roles. This not only prepares your business for your eventual exit but also provides stability and continuity, which are attractive to potential buyers.

If you're planning a management buyout as your exit strategy, this step is still crucial, especially if they are going to pay you over time (aka an earnout). You'll want to ensure the management team is capable of taking over and running the business successfully.

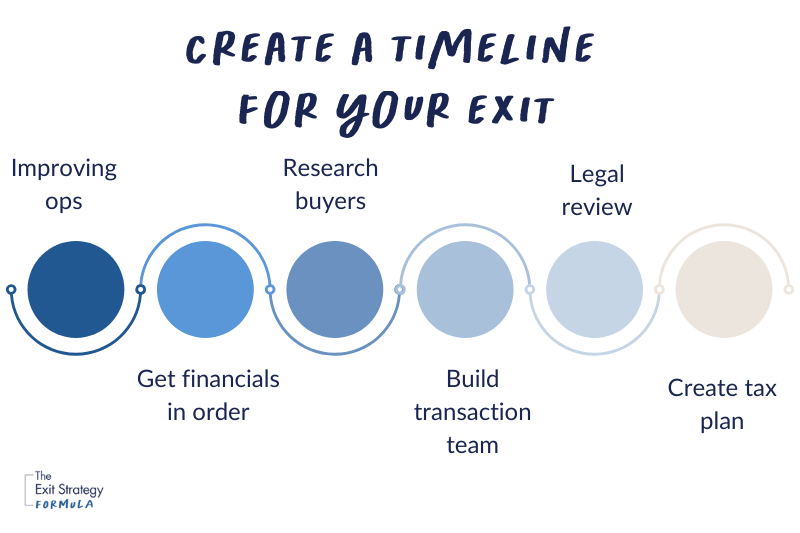

Step 6: Creating a Timeline for Your Business Exit Strategy Plan

Now it's time to put your exit strategy business plan into action. Create a realistic timeline with clear milestones. This might include targets for improving specific aspects of your business operations, deadlines for getting your financials in order, or dates for starting discussions with potential buyers.

Your timeline should also include preparing the necessary documentation. This typically includes:

Detailed financial records

A comprehensive business plan

Operational manuals and procedures

Contracts and agreements

Intellectual property documentation

Having all this information organized and ready can speed up the exit process and potentially increase your asking price. Gathering this information takes an unexpectedly longer amount of time than you likely think, and having to scramble during a transaction to pull it together under the microscope of potential buyers is a nightmare.

Step 7: Seeking Professional Guidance for Your Exit Strategy

Navigating a business exit can be complex. That's why it's crucial to seek professional guidance. Consider assembling a team of advisors, which might include:

A business broker or M&A advisor to help you find potential buyers and negotiate deals

An accountant to ensure your financials are in order and to advise on tax implications

A transaction lawyer to handle legal aspects of the sale and protect your interests

These professionals can provide valuable insights, help you avoid common pitfalls, and ultimately maximize the value you receive from your exit.

Frequently Asked Questions About Business Exit Strategies

What is an exit strategy in a business?

An exit strategy is a plan for transitioning out of business ownership. It outlines how and when you'll leave your company, whether through a sale, succession, or other means.

What is the best exit plan for a business?

The best exit plan depends on your specific situation, goals, and business type. It could be selling to a third party, passing the business to family, or even going public through an IPO.

What are the three main exit strategies?

While there are several exit strategies, three common ones are:

1. Selling to a third party

2. Passing the business to family members

3. Management buyout

What is the exit strategy of a business partnership?

In a business partnership, exit strategies might include selling your share to your partner(s), selling to a third party (with partner agreement), or liquidating the business. It's crucial to have these scenarios outlined in your partnership agreement.

Conclusion: Implementing Your Business Exit Strategy Plan

Planning your business exit strategy isn't just about preparing for the end – it's about maximizing the value of all your hard work. By following these seven steps, you're setting yourself up for a successful transition, whatever form that might take.

Remember, the best time to start planning your exit is now, even if you're not planning to leave anytime soon. A good exit strategy can help you build a stronger, more valuable business in the present while securing your future\

Next Steps: Refine Your Exit Strategy Business Plan

Ready to take control of your business's future?

As a business owner considering selling, you need to know if your enterprise is truly ready. The Ultimate Exit Readiness Report is your essential guide to assessing your business and maximizing its market value.

To discover your roadmap to a lucrative business exit, download the Ultimate Exit Readiness Report: Your Guide to Evaluating and Enhancing Your Business for Sale.

Remember, in the world of business, knowledge truly is power. By understanding your business's value inside and out and having a solid exit strategy, you'll be better equipped to achieve your entrepreneurial goals. Take the first step towards mastering your business exit strategy today.