Selling a Small Business? 5 Mistakes Making It Less Sellable

Selling a small business is kinda like preparing for a marathon. It takes preparation, strategy, and endurance. But here's the thing: many small business owners stumble before they even reach the starting line. Why? Because they're making crucial mistakes that make their businesses less sellable.

Let's dive into the five biggest mistakes that could be holding you back from a successful sale and how to avoid them. Trust me, this intel could be the difference between crossing the finish line with a win or watching from the sidelines.

Table of Contents

Mistake #1: Overvaluing Your Business

Methods for valuing a small business

Mistake #2: Neglecting Financial Records

Curious about your business's sale readiness and how to prepare?

Mistake #3: Failing to Plan Your Exit Strategy

Mistake #4: Ignoring Business Improvements Before Sale

Mistake #5: Mishandling the Sales Process

How much should a small business be sold for?

How hard is it to sell a small business?

What information should I prepare for prospective buyers?

How to calculate the value of a small business?

Mistake #1: Overvaluing Your Business

You've poured your heart and soul into your business. It's your baby. But when it comes to selling, emotions can cloud judgment faster than a toddler can make a mess.

Overvaluing your business is a surefire way to scare off potential buyers. It's crucial to get an accurate business valuation. This isn't just about slapping a price tag on your company – it's about understanding its true worth in the market.

Methods for valuing a small business

There are several methods for valuing a small business:

Asset-based valuation: This looks at the tangible and intangible business assets. It's particularly useful for businesses with significant physical assets.

Market-based valuation: This method assesses your business's value by examining recent sales of similar companies in your industry and market. It's kinda like looking at comps when selling a house.

Income-based valuation: This focuses on your business's ability to generate future income. It's often the most relevant for service-based businesses.

Pro tip: Consider getting a third-party valuation. It's kinda like having a neutral referee – it keeps everything fair and square. A valuation expert can provide an unbiased assessment of your business's worth, which can be invaluable when negotiating with potential buyers.

Remember, the asking price you set can make or break your sale. Set the asking price too high, and you'll scare off would-be buyers. Set it too low, and you might leave money on the table. A realistic business valuation helps you find that sweet spot.

Mistake #2: Neglecting Financial Records

Picture this: A potential buyer walks in, excited about your business. Then they ask to see your financial records, and you start sweating. Sound familiar?

Clean, organized financials are the backbone of a sellable business. Buyers want to see clear, accurate financial statements. They're not just being nosy – they need to understand the financial health of what they're potentially buying.

Key financial documents buyers want to see include:

Profit and loss statements

Balance sheets

Cash flow statements

Tax returns (usually for the past 3-5 years)

But it's not just about having these documents. The quality of your financial records can significantly impact your business's perceived value. Messy or incomplete records can raise red flags for potential buyers, making them question the accuracy of your reported earnings or the overall health of your business.

If your financial records look like a jigsaw puzzle, it's time to get them in order. Consider hiring a bookkeeper or accountant to help you clean things up. It's an investment that can pay off big time when you're ready to sell.

Also, don't forget about other important documents that potential buyers might want to see:

Contracts with key customers and suppliers

Lease agreements

Employee contracts

Intellectual property documentation

Having these legal documents organized and readily available can smooth the due diligence process and instill confidence in potential buyers.

Curious about your business's sale readiness and how to prepare?

Our FREE Ultimate Exit Readiness Report is your essential guide. It helps you identify and improve key areas to ensure you can sell confidently at maximum value.

This report offers a clear, actionable roadmap to navigate the exit process, empowering you to capitalize on this crucial business milestone.

Download now to start optimizing your exit strategy and secure the best possible outcome for your business's future.

Mistake #3: Failing to Plan Your Exit Strategy

Selling a small business without a strategy is like trying to navigate without a map. You might eventually get there, but the journey will be longer, harder, and more stressful than it needs to be.

An exit strategy isn't just about the sale itself. It's a comprehensive plan that covers:

Your personal and financial goals post-sale

The ideal timeline for your exit

How you'll prepare your business for sale

Who your potential buyers might be

How you'll handle the transition of ownership

The best time to start planning your exit? Yesterday. The second best time? Now. Even if you're not planning to sell for years, having a strategy can help you make better business decisions today.

Your strategy should also consider different scenarios. For instance, you might plan to sell to a family member, a key employee, or an outside buyer. Each of these options comes with its own set of considerations and potential challenges.

Remember, your exit strategy isn't set in stone. It should be a living document that you review and adjust regularly as your business and personal circumstances change.

Mistake #4: Ignoring Business Improvements Before Sale

Ever tried to sell a car without washing it first? The same principle applies to your business. Ignoring necessary improvements before a sale can seriously impact your business's sellability.

Key areas to focus on include:

Streamlining operations: Look for ways to make your business more efficient. This could involve automating processes, reducing waste, or improving your supply chain.

Strengthening your customer base: A diverse and loyal customer base is attractive to buyers. Work on customer retention strategies and try to reduce reliance on any single customer.

Updating technology and equipment: Outdated technology can be a major turn-off for buyers. Invest in necessary upgrades to keep your business competitive.

Resolving any legal or regulatory issues: Outstanding legal issues or non-compliance with regulations can be deal-breakers. Address these issues before putting your business on the market.

Improving your business model: Look for ways to make your revenue more predictable and recurring. This could involve introducing subscription services or long-term contracts.

But here's the catch: you need to balance improvements with ROI. Don't pour money into changes that won't increase your sale price. Focus on improvements that will make your business more attractive to potential buyers.

It's also worth considering the timing of these improvements. Some changes might take time to show results, so plan accordingly. You want potential buyers to see the positive impact of these improvements in your financials.

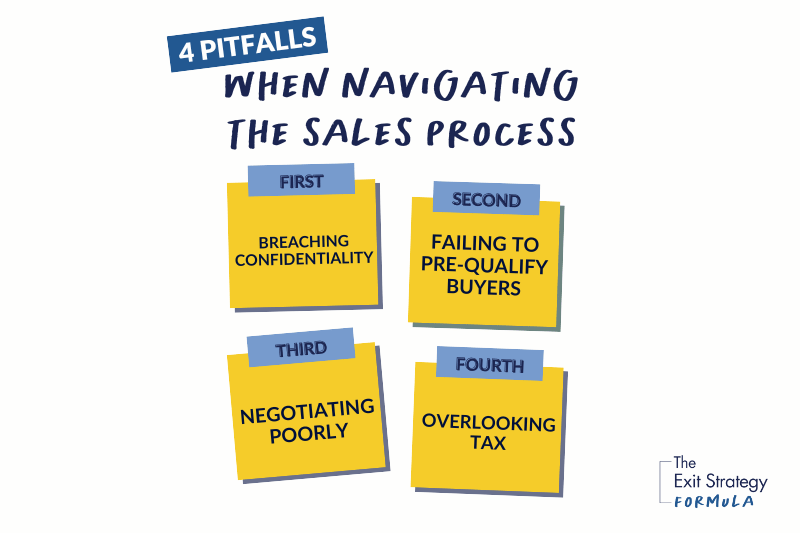

Mistake #5: Mishandling the Sales Process

The process can be a minefield if you're not careful. Common pitfalls include:

Breaching confidentiality

Loose lips sink ships. Premature disclosure of your intention to sell can unsettle employees, customers, and suppliers.

Failing to pre-qualify buyers

Not all potential buyers are created equal. Wasting time on tire kickers can distract you from serious prospects.

Negotiating poorly

Negotiation is an art. Poor negotiation skills can leave money on the table or even kill the deal.

Not having proper legal documentation.

A handshake deal isn't enough. Proper legal documentation protects both you and the buyer.

Overlooking tax implications

The structure of your sale can have significant tax consequences. Don't neglect this crucial aspect.

This is where professional help can be a game-changer. A business broker can help you navigate the process, find qualified buyers, and negotiate deals. They're kinda like your personal guide through the business-selling wilderness.

And don't forget about legal help. A good lawyer can ensure all your t's are crossed, and i's are dotted in the sales agreement. They can also help you understand the legal implications of different sale structures.

Remember, the sales process doesn't end when you accept an offer. You'll likely need to stay involved during a transition period to ensure a smooth handover to the new owner.

Frequently Asked Questions

Now, let's tackle some burning questions you might have:

How much should a small business be sold for?

There's no one-size-fits-all answer here. The selling price depends on various factors, including your business's financials, assets, industry, and market conditions. Generally, small businesses often sell for 2-3 times their annual cash flow. But remember, this is just a rule of thumb. Your business might be worth more (or less) depending on its unique characteristics.

Factors that can influence the selling price include:

Historical and projected financial performance

The strength of your customer base

The condition of your business assets

The state of the market and your industry

Intellectual property and brand value

The level of competition

How hard is it to sell a small business?

I won't sugarcoat it – selling a small business can be challenging. It takes time, effort, and patience. On average, it takes 6-9 months to sell a small business. But with proper preparation and the right help, you can make the process smoother and potentially faster.

Challenges in selling a small business can include:

Finding qualified buyers

Maintaining confidentiality during the sale process

Negotiating a fair price

Managing the due diligence process

Handling the emotional aspects of letting go

What information should I prepare for prospective buyers?

Prospective buyers will want to see a comprehensive picture of your business. Be prepared to provide:

Detailed financial statements: This includes profit and loss statements, balance sheets, and cash flow statements for the past 3-5 years.

Tax returns: Usually for the same period as your financials.

List of assets: Include all equipment, inventory, and intellectual property.

Customer and supplier information: Provide details on your top customers and key suppliers, while maintaining confidentiality.

Employee information: Outline your organizational structure and key personnel.

Business operations manual: This shows that your business can run smoothly without you.

Lease agreements: If you rent your business premises.

Licenses and permits: Show that your business is compliant with all regulations.

Marketing materials: This helps buyers understand your brand and market position.

Growth opportunities: Highlight potential areas for expansion or improvement.

Remember, you'll want prospective buyers to sign a non-disclosure agreement (NDA) before sharing sensitive information. This protects your business interests during the sale process.

How to calculate the value of a small business?

Calculating the value of a small business involves several steps:

Gather your financial documents (profit and loss statements, balance sheets, tax returns)

Determine your Seller's Discretionary Earnings (SDE)

Research industry multiples

Apply the multiple to your SDE

Adjust for assets and liabilities

Remember, this is a simplified version. For a more accurate valuation, consider working with a valuation expert or business broker.

What is the formula for selling a small business?

While there's no magic formula for selling a small business, there is a proven process that can significantly increase your chances of a successful sale. This is where The Exit Strategy Formula program comes in.

The Exit Strategy Formula is a step-by-step program designed to help small business owners prepare for a successful sale. It covers everything from valuing your business accurately to negotiating the best deal. The program breaks down the complex process of selling a business into manageable steps, giving you the confidence and know-how to navigate your exit like a pro.

Key components of the program include:

How to accurately value your business

Strategies for increasing your business's value before sale

How to prepare your financials for buyer scrutiny

Techniques for finding and attracting potential buyers

Negotiation strategies to get the best price

How to handle the due diligence process

Ready to take the next step? Here's what you can do:

Review your business with fresh eyes. Are you making any of the mistakes we've discussed?

Start working on your strategy, even if you're not planning to sell immediately.

Consider professional help. Whether it's a business broker, accountant, or lawyer, expert advice can be invaluable.

Remember, selling a small business is a journey, not a sprint. The more prepared you are, the smoother that journey will be.

Next Steps

Want to assess your business's readiness for sale and what steps to take in the interim? The FREE Ultimate Exit Readiness Report is designed to help you do just that. By understanding and addressing key areas, you can prepare your business to sell confidently and at the highest value. This report provides a clear, step-by-step roadmap to guide you through the process, ensuring you are fully prepared to make the most of this critical opportunity.