From Idea to Investment: How to Value a Startup Company with No Revenue

Picture this: You've got a groundbreaking idea, a passionate team, and the drive to change the world. But there's one small catch – your startup hasn't generated a single dollar of revenue yet. So, how do you put a price tag on potential? Welcome to the intricate world of pre-revenue startup valuation.

Valuing a startup with no revenue is kinda like trying to predict the weather a year in advance. It's challenging, requires a mix of art and science, and can have a massive impact on your future. But while it might seem daunting, it's not impossible. With the right approach, you can arrive at a valuation that's both credible and attractive to potential investors.

In this guide, we walk through the process of valuing a pre-revenue startup. We explore the factors that influence valuation, popular valuation methods, and tips to help you maximize your startup's value.

So, whether you're a founder looking to raise capital or an investor eyeing the next big thing, buckle up – we're about to turn your idea into a solid investment opportunity.

Side note - when discussing the value of a startup company, it's crucial to differentiate between pre-money and post-money valuations. The pre-money valuation refers to the value of the startup before it receives any external funding. This is often the figure that founders and investors negotiate over. For instance, if a startup raises $3 million at a $10 million pre-money valuation, the post-money valuation would be $13 million. Understanding this distinction is key for founders, as it directly impacts the equity stake they'll retain after investment.

Table of Contents

Key Differences Between Startup Company Valuation and Mature Business Valuation

Understanding Pre-Revenue Startups

Factors That Influence Pre-Revenue Startup Valuation

Ready to dive deeper into the world of valuation?

How to value a startup company with no revenue

Popular Pre-Revenue Startup Valuation Methods

Comparable Transactions Method

Step-by-Step Guide to Valuing Your Pre-Revenue Startup

Common Pitfalls in Pre-Revenue Startup Valuation

Tips for Maximizing Your Startup's Value

What is an exit strategy in a business?

Key Differences Between Startup Company Valuation and Mature Business Valuation

Before we dive into the nitty-gritty of startup valuation, let's take a moment to understand how it differs from valuing an established business. When it comes to mature companies, valuation often relies heavily on financial metrics like revenue, profits, and cash flow. These businesses have a track record, making it easier to predict their future performance.

For a deep dive into how mature businesses are valued, check out our comprehensive guide: What Is Business Valuation Exactly? Here's a Beginner's Guide. This resource will give you a solid foundation in traditional valuation methods.

Now, when it comes to pre-revenue startups, we're dealing with a whole different ballgame. Without historical financial data to lean on, we need to get creative with startup valuation methods. We're not just crunching numbers – we're evaluating potential, assessing risk, and sometimes, putting a price on dreams. It's less about what the company has done and more about what it could do.

Understanding Pre-Revenue Startups

So, how exactly are we defining a pre-revenue startup here? Simply put, it's a company that's still in its early stages and hasn't started generating income yet. Early stage startups are often still developing their product or service, fine-tuning their business model, or building their customer base.

The challenge with valuing these companies is that traditional valuation methods, which rely heavily on financial performance, just don't cut it. It's like trying to judge a chef's skills before they've cooked their first meal. You can't taste the food, but you can assess their training, their recipe, and the quality of their ingredients.

Early stage startup companies often face unique challenges in valuation. At this point, they're primarily selling a business idea rather than a proven product or service. Investors must assess the potential of this idea in the context of the market, the team's ability to execute, and the scalability of the concept. This is why valuation methods for early stage startups often focus more on qualitative factors than on financial projections.

Factors That Influence Pre-Revenue Startup Valuation

What factors are involved to value a startup? When valuing a pre-revenue startup, we need to look beyond the (non-existent) balance sheet. Here are the key factors that can make or break a startup's valuation:

The Dream Team

The quality of the founding team is crucial. Investors aren't just buying into an idea; they're betting on the people who can turn that idea into reality. A team with a track record of success, relevant industry experience, and complementary skills can significantly boost a startup's value.

Market Potential

Is your startup addressing a tiny niche or a massive, untapped market? The size of the opportunity can greatly impact valuation. Investors are looking for scalable ideas that can capture significant market share.

The Secret Sauce

Intellectual property and technology can be a startup's most valuable asset. Unique, patented technology or a revolutionary algorithm can set your startup apart and justify a higher valuation.

Proof of Concept

While you might not have revenue, having a working prototype or MVP (Minimum Viable Product) can demonstrate the viability of your idea. It's tangible evidence that you're not just all talk.

Early Adopters and Traction

Even without revenue, signs of market interest can be valuable. This could be a waiting list of potential customers, letters of intent, or strong engagement on a landing page.

Strategic Relationships

Partnerships with established companies or support from industry leaders can lend credibility to your startup and boost its perceived company value.

Ready to dive deeper into the world of valuation?

Grab our free resource: The Ultimate Business Valuation Starter Guide.

This actionable cheat sheet will walk you through a proven process to help you discover the 4 essential factors in valuing a business. Get clarity and traction to pinpoint what's important, helping you sidestep the misleading myths that are commonplace in the market.

Don't leave your startup's value to chance – get your guide today and start your journey towards a winning valuation!

Get Your Business Valuation Starter Guide.

How to value a startup company with no revenue

Popular Pre-Revenue Startup Valuation Methods

Now that we understand what influences a startup's value let's explore some popular methods for putting a number on that value. Remember, valuation (when it comes to pre-revenue startups and early stage companies) is more of an art than an exact science. These methods provide a framework, but THEY SHOULD BE USED AS A STARTING POINT, not gospel.

While traditional valuation methods like the discounted cash flow model are often less applicable to pre-revenue startups, they're not entirely irrelevant. Some investors might still use a modified version of this approach for startup valuation. In this case, they'd project potential future cash flows based on the startup company's business plan and market potential, then discount these projections heavily to account for the high risk and uncertainty. However, given the speculative nature of these projections for a pre-revenue startup, this method is typically used in conjunction with other valuation approaches to get a more comprehensive picture.

The Berkus Method

This method, named after angel investor Dave Berkus, assigns a monetary value to 5 key success factors: sound idea, prototype, quality management team, strategic relationships, and product rollout or sales. Each factor can add up to $500,000 to the company's value for a maximum pre-money valuation of $2.5 million.

The Berkus Method is simple and quick, making it popular among angel investors. However, it's limited by its $2.5 million cap and doesn't account for market conditions or industry differences.

It's worth noting that while he originally developed the Berkus Method in the 1990s, he has since updated the values to reflect current market conditions. Some investors now use higher values per factor, adjusting for inflation and the overall increase in startup valuations over the years.

Scorecard Valuation Method

This approach compares your startup to similar funded companies in your region. You start with the average pre-money valuation of pre-revenue companies in your industry and then adjust based on how you compare in areas like the strength of the management team, size of the opportunity, product/technology, competitive environment, marketing/sales channels/partnerships, need for additional investment, and other factors.

Region matters in this method because startup valuations can vary significantly across different geographical areas. For instance, a tech startup in Silicon Valley might command a higher valuation than a similar startup in a smaller tech hub due to factors like:

Investor expectations and norms in different ecosystems

Availability of venture capital in the region

Cost of living and doing business, which affects burn rates and funding needs

Access to talent pools

Proximity to potential customers or partners in certain industries

The Scorecard method provides more flexibility than the Berkus Method and allows for consideration of local market conditions. However, it requires good data on comparable company valuations, which isn't always easy to find.

Risk Factor Summation Method

This method starts with an average pre-money valuation for pre-revenue startups in your region and industry. It then considers 12 risk factors, adjusting the valuation up or down based on each factor. These factors include management, stage of business, legislation/political risk, manufacturing risk, sales and marketing risk, funding/capital raising risk, competition risk, technology risk, litigation risk, international risk, reputation risk, and potential lucrative exit.

This method provides a comprehensive risk assessment but can be complex and subjective in its risk evaluations.

Valuing startups is as much an art as it is a science, and venture capitalists (VCs) often have their own unique approaches. These seasoned investors have seen countless pitches and have developed a keen sense for spotting potential unicorns. When valuing startups, VCs often look beyond the numbers, considering factors like the founder's vision, the team's ability to execute, and the startup's potential to disrupt entire industries. They're not just investing in what a company is today but what it could become in the future. This forward-looking approach is why VC valuations can sometimes seem inflated compared to traditional business valuations.

Venture Capital Method

Popular among VCs, this method focuses on the startup's potential future value. It involves estimating the startup's value at exit (usually 3-7 years in the future) and then working backward to determine the current post-money valuation.

The formula is: Post-money Valuation = Terminal Value ÷ (1 + IRR)^n, where Terminal Value is the anticipated selling price of the company, IRR is the expected Internal Rate of Return (often 30-60% for VC investments), and n is the number of years to exit.

This method aligns well with how VCs think about investments but relies heavily on future projections, which can be highly speculative for pre-revenue startups.

When valuing startups, looking at comparable companies can provide valuable insights. However, finding truly comparable companies for an innovative startup, like tech startups, can be challenging. Startups often operate in new or rapidly evolving markets, making direct comparisons difficult. When using this approach, it's crucial to consider factors beyond just industry or size. Look for companies with similar business models, growth rates, or target markets.

Remember, the goal isn't to find an exact match but to gather data points that can inform your valuation. Adjustments will almost always be necessary to account for the unique aspects of your startup.

Comparable Transactions Method

This approach looks at the valuations of similar startups that have recently received funding. By analyzing these comparable transactions, you can estimate what investors might be willing to pay for your startup.

While this method can provide real-world benchmarks, finding truly comparable pre-revenue startups can be challenging, and the data may not always be publicly available.

Cost-to-Duplicate Approach

This method estimates how much it would cost to build an identical company from scratch. It considers expenses like physical assets, product development, and building the team.

Importantly, this approach doesn't just include the costs you actually incurred but also the costs a new entrant would face today. This means it might include expenses you avoided (like if you got a great deal on office space) and exclude costs that wouldn't be repeated (like early pivots or a few mistakes).

While straightforward, this approach often undervalues startups as it doesn't account for future potential or intangible assets like brand value and strategic relationships.

Step-by-Step Guide to Valuing Your Pre-Revenue Startup

Now that we've covered the theory let's walk through the process of actually valuing your pre-revenue startup:

Gather Information

Start by collecting all relevant information about your startup. This includes details about your founding team, product, market research, any traction or early adopters, strategic relationships, and future plans.

Choose Your Method(s)

Based on your startup's specific situation and the information available, select one or more valuation methods that seem most appropriate. It's often helpful to use multiple methods and compare the results.

Apply the Method(s)

Work through your chosen valuation method(s). Be as objective as possible, and don't be afraid to seek input from advisors or mentors who can provide an outside perspective.

Analyze and Adjust

Look at the results critically. Do they seem realistic, given your industry and stage? Adjust as necessary based on factors that might not be fully captured by the valuation method.

Prepare Your Narrative

Remember, the number you arrive at is just part of the story. Be ready to explain how you arrived at your valuation and why it's justified. Your ability to articulate your startup's value proposition can be just as important as the valuation itself.

Common Pitfalls in Pre-Revenue Startup Valuation

As you work through your valuation, be aware of these common mistakes:

Overvaluation

It's natural to be optimistic about your startup, but overvaluation can scare off potential investors or lead to down rounds in the future. Be realistic and be prepared to justify your numbers.

Ignoring Market Conditions

Your startup doesn't exist in a vacuum. Economic conditions, industry trends, and the overall funding environment can all impact valuation. Stay informed about what's happening in your market.

Failing to Account for Dilution

Remember that future funding rounds will dilute your ownership. Factor this into your thinking about valuation and equity.

Overemphasis on Financial Projections

While projections are important, they're also highly speculative for pre-revenue startups. Don't rely too heavily on these numbers in your valuation.

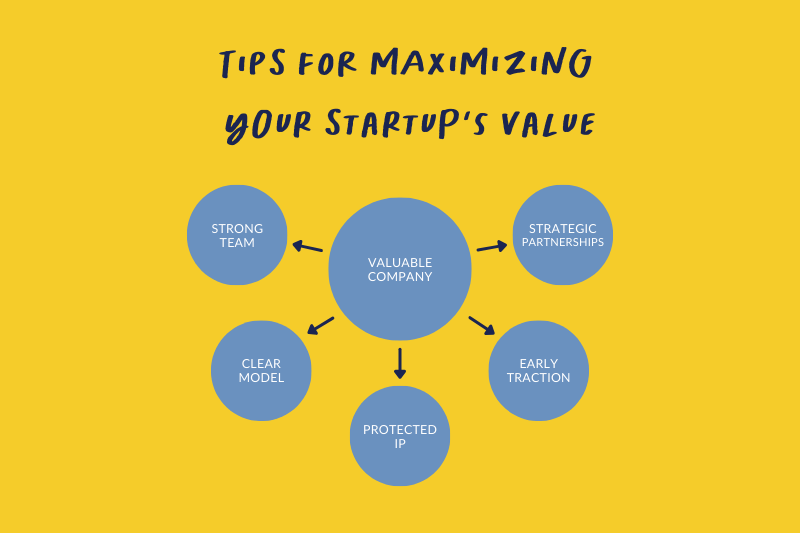

Tips for Maximizing Your Startup's Value

While valuation methods are important, the real key to a high valuation is building a valuable company. Here are some strategies to boost your startup's worth:

Build a Strong Team

Surround yourself with talented individuals who complement your skills. A diverse, experienced team can significantly increase investor confidence.

Develop a Clear Business Model

Know how your company will make money and scale. A well-thought-out business model demonstrates that you've considered the practicalities of turning your idea into a sustainable business.

Protect Your Intellectual Property

If your startup is based on unique technology or processes, make sure they're properly protected through patents, trademarks, or copyrights.

Gain Early Traction

Even without revenue, you can demonstrate market interest. This could be through a mailing list, pre-orders, or partnerships with potential customers.

Cultivate Strategic Partnerships

Relationships with established companies in your industry can provide validation and potentially open doors to customers or resources.

Frequently Asked Questions

What is an exit strategy in a business?

An exit strategy is a plan for how the founders and investors will eventually "cash out" their investment in the company. This could involve selling the company, going public through an IPO, or even liquidating the assets.

What is the best exit plan for a business? The best exit plan depends on your specific goals and circumstances. Common options include selling to a larger company, going public, or passing the business on to family members or employees.

What are the three main exit strategies?

The three main exit strategies are typically:

Acquisition (selling to another company)

Initial Public Offering (IPO)

Management Buyout (selling to the company's management team)

What is the exit strategy of a business partnership? In a business partnership, exit strategies might include buying out other partners, selling your share to a new partner, or collectively selling the entire business. Having these scenarios outlined in your partnership agreement from the start is crucial.

Conclusion

Valuing a pre-revenue startup is challenging but a critical step in the journey from idea to investment. By understanding the factors that influence valuation and familiarizing yourself with various valuation methods, you can arrive at a number that fairly represents your startup's potential.

Remember, valuation is both an art and a science. While the methods we've discussed provide a framework, they're just a starting point. Your startup's true value lies in its potential to solve problems, disrupt industries, and create meaningful change.

As you move forward with your valuation, stay realistic, be prepared to justify your numbers, and focus on building a truly valuable company. You can turn your pre-revenue startup into an attractive investment opportunity with the right approach.

Next Steps

Sign up for our free guide: The Ultimate Business Valuation Starter Guide.

This actionable cheat sheet will walk you through a proven process to help you discover the 4 essential factors in valuing a business. Get clarity and traction to pinpoint what's important, helping you sidestep the misleading myths that are commonplace in the market.

Don't leave your startup's value to chance – get your guide today and start your journey towards a winning valuation!