Inside a Business Exit Strategy Process | The Exit Strategy Formula

DEMYSTIFY THE BUSINESS SELLING PROCESS

(INSIDE THE EXIT STRATEGY FORMULA)

Do you have ASPIRATIONS to sell your business?

Or you have an offer from a potential buyer but don't know where to start?

Maybe you want right-sized intel for entrepreneurs (not accountants)?

If you're answering "YES" over there – I have just the thing for you.

As I worked at financial advisory firms throughout my 20-year career, clients would call and say they'd just handed over their financial statements to a would-be buyer and wondered what they should do next.

We would suggest they hire us to help them with their exit strategies.

The conversation would turn to the fees we would charge.

Then the client would decide whether they wanted to hire us.

Sometimes we would be engaged to help, and other times the business owner would go the DIY route.

Most business owners avoid hiring experts because they think it will cost a fortune. And honestly, it usually does.

But if you've never sold a business before, how are you supposed to navigate the business selling process?

Selling a Business is Complex

Let's look at how this typically goes down. Have you seen the stats?

75% of business owners plan to exit their businesses in the next 10 years

70% of most entrepreneurs' wealth is tied up in the value of their businesses

50% of business sales fall apart in the due diligence phase

When deals fall apart in due diligence (aka the phase of a transaction where a potential new owner reviews the company in detail), that means the entrepreneur:

found at least one interested buyer

negotiated a preliminary price and terms, but

when the buyer pulled back the curtains, what they saw caused them to walk away or negotiate the price down so low the seller lost interest.

If you've never sold a business before, will you suffer the same fate?

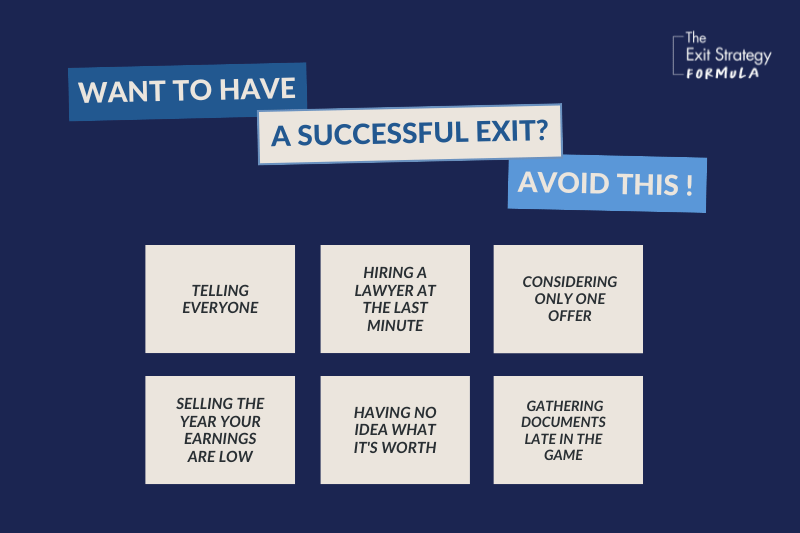

Getting the highest price and the most secure arrangement for your business when you sell is complicated.

If you've never gone through a transaction before, it's hard to navigate the business selling process

Most information out there is too generic or geared toward big businesses, not small businesses

You have to side-step all the advisors that want to take a percentage of your transaction price

It's hard to know where to start and who to trust!

Especially when you're busy with business operations and aren't even sure if you want to sell right now.

We know that if you don't have a map, it will not end well. Sure, there's always the exception business that sells out of the blue at a price that exceeds expectations, but that's not the norm.

If you're like most entrepreneurs, you're likely wondering:

"How do you account for future growth in the asking price?"

"What financial information do I give to a buyer and when?"

"Is selling my business to a family member a good exit strategy?"

"How do I know if an offer that appears generous actually is?"

"How do I navigate the process without my employees finding out?"

It's for all these reasons and more that I've put together an EPIC collection of next-level exit strategies, resources, pieces of training and support. This practical guide is designed to support business owners with aspirations to sell, find their target market and navigate the business sale process.

Demystify the business selling process with the right-sized intel

From the steps in a transaction to which approach is best so that business owners with aspirations to sell can confidently negotiate the best deal.

Ensure you're thinking about all the right things with your business exit strategy

Assemble a winning transaction team

Know what to do when you get an unsolicited offer

Discover if now is actually the "right time" to sell your business

If your succession planning includes selling your small business ONE DAY as your exit strategy, you might not be sure if now is the best time to sell to maximize profits.

A great place to start is by taking my FREE assessment for business owners with aspirations to sell. You answer a few questions, and we'll assess your business's unique attributes and give you a customized 3-step action plan.

Your roadmap to a successful business exit strategy

My Exit Strategy Formula program will walk you through overcoming the obstacles that most small business owners face during common exit strategies.

The 3 key phases to successfully exiting a business are:

Planning With the End in Mind

Optimizing for Maximum Payoff

Positioning for a Successful Exit

The Exit Strategy Formula is a framework that considers the current market conditions, personal goals, business goals, and financial situation to help you navigate your best exit strategy. This practical guide will help you to understand the best time for YOU to sell based on YOUR unique circumstances.

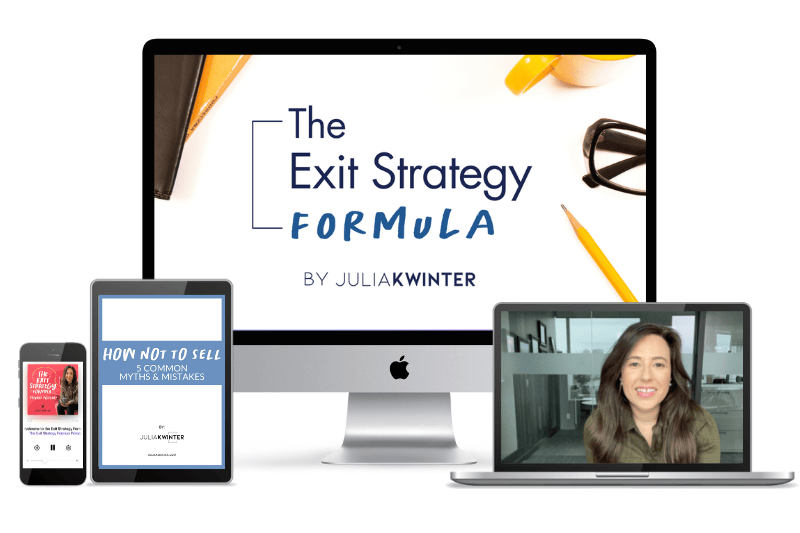

WE'VE GOT SOME OF THE MOST IN-DEMAND INTEL FOR YOU!

The Exit Strategy Playbook walks you through the steps in a transaction so that you know the process the pros follow and can present yourself as a knowledgeable seller, which helps you get the best deal. From how to let potential buyers know you're selling and how to respond to potential buyers' various questions

On-Demand Trainings - digestible 5 to 10-minute videos explaining the key concepts and the step-by-step framework most transactions follow

Customizable worksheets and assignments for each training designed to help you create momentum and clarity on exactly how to bring your business to market

Who to Talk to Guide details who you can hire if you decide you need extra help when to hire a lawyer, and the pros and cons of hiring a business broker

Unbiased, Independent Advice from someone who is not trying to get hired to sell your business so that you can make informed decisions for yourself

The "No Question is Too Stupid" Answer Vault - answers to common questions business owners have asked in the past. Can't find an answer to your question? Submit it to the vault, and we'll answer it.

Since The Exit Strategy Formula is an on-demand course, it means that once you join, you will have instant access to all of the advanced training we have inside for the lifetime of the program.

Now, we get a lot of questions about The Exit Strategy Formula and how it really works.

Let's answer some of the most common questions! 😎

I DON'T PLAN TO SELL MY BUSINESS RIGHT AWAY, WILL THIS COURSE WORK FOR ME?

The best time to take this course is well before any potential transaction. Here's the thing, many business owners need 3 to 5 years to prepare for an exit event. But people rarely know when exactly they will sell or when they'll find an attractive option to buy. The sooner you know this information, the better.

WHAT IF I'M NOT A NUMBERS PERSON? WILL THIS STILL BE USEFUL FOR ME?

There are a couple of things you do not need in this course: you do not need a lot of time, and you do not need an accounting background. We are sticking to the BIG picture, the steps that have a big impact. If there's any technical jargon you're unfamiliar with, we have a "no question is too stupid" answer vault. And the more you let the finance lingo wash over you, the more comfortable you'll be when you hear it again.

WHAT'S THE FORMAT OF THE PROGRAM?

The Exit Strategy Formula course materials are shared as video content, and most lessons are in the 5 to 10-minute range to keep them digestible. There are also fillable, customizable worksheets and printable PDF guides and workbooks.

HOW MUCH TIME WILL THIS REQUIRE?

That's ultimately up to you and your timeline, as it's entirely self-paced. There are roughly 2 hours of bite-sized videos, examples, exercises and reference worksheets. Depending on your timeline, The Exit Strategy Formula content can be consumed in as little as a weekend. If you have an imminent transaction, give me a few hours over a couple of days, and you will walk away with an understanding of how to get the best deal for your company! The audio version, delivered as a private podcast, will help you get a jump-start on the material.

Ready to take the guesswork out of your business exit strategy?

Join us inside The Exit Strategy Formula now!

If you're not sure if now is actually the "right time" to sell, a great place to start is by taking my FREE assessment. You answer a few questions, and we'll assess your business value and give you a customized 3-step action plan for selling your business.

© 2022 Julia Kwinter. All Rights Reserved.