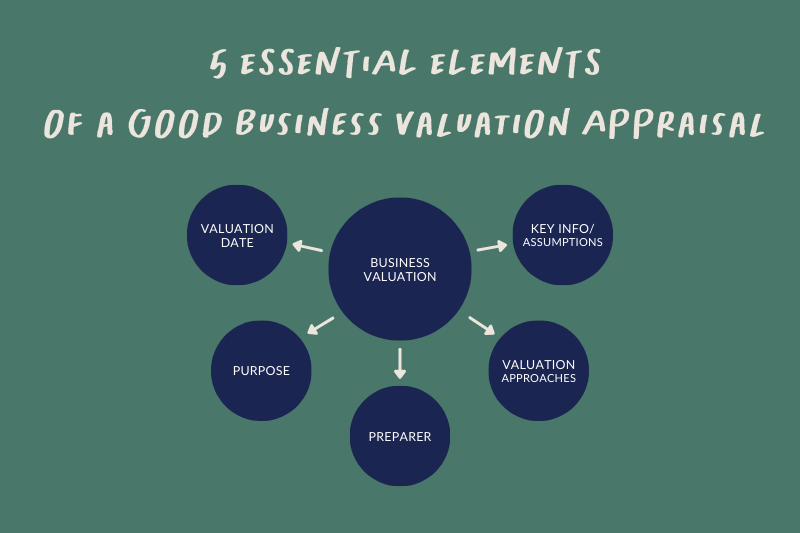

5 Essential Elements of a Good Business Valuation Appraisal

Table of Contents

2. The Purpose of the Valuation

4. Discussion Of Valuation Approaches

5. Key Information and Assumptions

Revenue and Earnings Projections

Introduction

A business appraisal is a crucial tool for any company, whether they're looking to sell, secure financing, or simply understand their worth. The purpose of these valuations is to determine the fair market value of a business - essentially, the amount a buyer would pay if it were for sale. In this article, we'll explore the five essential elements that must be considered in a thorough business appraisal, providing insights that can be valuable for everything from business sales to establishing buy-sell agreements.

The Five Essential Elements

1. The Valuation Date

Is the date of a business valuation important? Absolutely. The valuation date is crucial because a company's value can change significantly over time. A business value estimate represents an organization's worth at a specific point in time. Both internal factors (such as financial performance, management changes, or new service offerings) and external factors (like market conditions, economic trends, or regulatory changes) can impact a company's value.

For instance, a consulting firm's value might increase substantially after winning a major long-term contract with a Fortune 500 company, or it might see its value decrease if several key employees leave to start their own firm. Therefore, a new evaluation is required to provide appropriate support for future decisions or transactions. When reviewing an appraisal, always check the valuation date to ensure the information is current and relevant to your needs.

2. The Purpose of the Valuation

Understanding the purpose of a business valuation is crucial because valuations can be prepared for different reasons, each potentially influencing the approach and outcome. A good appraisal should clearly indicate its purpose, allowing you to assess any inherent bias.

For example:

If the valuation is prepared for financing purposes, it might lean towards a higher value to secure better loan terms.

A valuation prepared by a seller for exit planning or a transaction might be optimistic, while one prepared by a buyer could be more conservative.

Valuations for estate tax purposes might aim for a lower value to reduce tax liability.

In divorce cases, the valuation might be influenced by the party commissioning it. The spouse retaining the business might prefer a lower valuation, while the other spouse might push for a higher value.

By understanding the purpose, you can better interpret the results and identify potential areas of bias or contention. This is particularly important in situations involving buy-sell agreements, where the valuation purpose can significantly impact the terms of the agreement.

3. The Preparer

The credibility of a business appraisal heavily depends on the preparer. When evaluating an appraisal, consider the following about the preparer:

Qualifications: Do they hold relevant designations such as Chartered Business Valuator (CBV) or Accredited Senior Appraiser (ASA)?

Experience: How long have they been conducting valuations? Do they have specific experience in your industry?

Expertise: Do they possess the necessary technical skills and knowledge for your particular valuation needs?

Independence: Is the preparer truly independent, or do they have ties to interested parties?

Affiliation: Who do they work for? Are they employed by one of the shareholders or the business itself?

Funding: Who paid for the valuation? This can help you determine potential bias.

An appraiser working directly for the business or one of its shareholders may have an inherent bias. Always question who commissioned and paid for the valuation to better understand potential influences on the results.

4. Discussion Of Valuation Approaches

A comprehensive appraisal should discuss the main valuation methods considered:

Asset Approach: This method values the business based on its tangible and intangible assets less its liabilities. It's particularly useful when assessing a company's assets, especially for businesses with significant tangible assets.

Market Approach: This method compares the business to similar companies that have recently sold. It's often used in business sales scenarios, providing a real-world perspective on the company's value.

Income Approach: This method estimates value based on the business's expected future cash flows. It's particularly relevant for businesses with strong growth potential or stable cash flows.

Each method provides a different perspective on the business's value, and considering all three ensures a well-rounded appraisal. The chosen approach can significantly impact the final valuation, so it's crucial to understand why a particular method was selected.

Selected Valuation Method

The appraisal should clearly state which method(s) the final conclusion relies on. It's common for appraisers to use multiple methods and reconcile the results.

The report should explain why the chosen method(s) were deemed most appropriate. This decision typically depends on factors such as:

The business's nature and industry

Availability of reliable market data

The company's financial history and projections

The purpose of the valuation

For example, the Income Approach might be favored for a growing consulting firm with strong cash flows, while the Asset Approach could be more suitable for a manufacturing company with significant tangible assets.

5. Key Information and Assumptions

A quality business appraisal should clearly outline the key information and assumptions used in the analysis. This transparency allows readers to understand the basis of the valuation and assess its reliability.

Financial Information

The appraisal should detail the financial information used, which typically includes:

Historical financial statements (usually 3-5 years)

Current year-to-date financials

Tax returns

Financial projections or forecasts

The appraiser should note whether these financials were audited, reviewed, or compiled, as this affects their reliability. Any adjustments made to the financials (such as normalizing owner's compensation or removing non-recurring expenses) should be clearly explained.

Key assumptions might include:

Projected growth rates

Future profit margins

Working capital requirements

Capital expenditure needs

The appraisal should also address any limitations or uncertainties in the financial information provided. Remember, the quality of the valuation is only as good as the information it's based on. A thorough discussion of this data helps establish credibility and provides context for the valuation conclusion.

Additional Considerations

While the five elements above form the core of a business valuation appraisal, several other factors play crucial roles in the process:

Revenue and Earnings Projections

Revenue and earnings projections are foundational to any business appraisal. The appraiser uses historical financial performance data, market trends, and other relevant information to create a comprehensive picture of the business's expected future financial performance. This includes forecasting future revenue and earnings, as well as considering any one-time or unusual expenses that may impact performance.

These projections are essential because they provide a basis for calculating the future value of the business. For instance, a business expected to generate steady revenue growth over the next several years will likely be worth more than one anticipating declining revenue. The appraiser must have a deep understanding of the business and its industry to make accurate projections.

Market Data

Market data is another critical element of business valuations. The appraiser will use this data to compare the business being valued with similar companies in the same industry. This may include information on comparable transactions, industry benchmarks, and financial performance metrics.

By comparing the business being valued with similar businesses, the appraiser can gain insight into the factors that impact business value and determine the fair market value. For example, if the business operates in a highly competitive industry, the appraiser may adjust the valuation downward to reflect the impact of competition on financial performance. Conversely, for a business in a high-growth industry, the valuation might be adjusted upward to reflect future potential.

Business Risks and Uncertainties

Business risks and uncertainties are critical components of any certified business appraisal. Appraisers must consider the potential impact of these factors on the business's financial performance and future value. This includes considering changes in the market, economic conditions, competition, and government regulations.

Additionally, the appraiser must consider the impact of potential liabilities, such as lawsuits or environmental issues, that may negatively impact the business's value. Accurately accounting for these risks and uncertainties requires a deep understanding of the business and its industry, as well as consideration of historical performance and future industry outlook.

Owner's Interest

The owner's interest is perhaps the most important element of a business appraisal. The appraiser must consider the specific interests and objectives of the business owner, such as the intended use of the valuation and the future plans for the business.

For example, if the owner is looking to sell, the appraiser must consider the impact of the sale on the business's value. For a closely held family business, the owner's personal involvement might significantly affect the value. If the owner is seeking financing, the appraiser needs to consider how this might impact the business's value.

The appraiser must also consider the owner's personal goals and objectives. For instance, if the owner plans to pass the business to the next generation, the appraiser must consider how this exit strategy affects the business's value. Similarly, if the owner intends to liquidate, this too will impact the valuation.

Conclusion

Business appraisals are complex, nuanced processes requiring a deep understanding of the company, its industry, and the owner's specific interests and objectives. By considering these five essential elements - the valuation date, purpose, preparer, valuation approaches, and key information and assumptions - along with additional factors like revenue projections and market data, a certified appraiser can provide an accurate and comprehensive assessment of a business's fair market value.

Whether you're preparing for a business sale, establishing buy-sell agreements, or simply want to understand your company's worth, a thorough business appraisal is an invaluable tool. It provides crucial insights that can help you make informed decisions about your business's future. While some may attempt to conduct their own informal valuations, complex situations often benefit from professional business valuation services to ensure accuracy and credibility.

Frequently Asked Questions

Can a business have more than one value?

Absolutely! A company can have multiple value points at any given time. It depends on your perspective and the information you're working with. Different viewpoints or data can lead to different valuations - all potentially valid in their own context.

Can I do my own business valuation?

Sure, you can conduct informal valuations anytime. But for complex situations involving multiple companies or partners, you'll want an independent valuer. My program, The Valuation Formula, teaches you what your appraiser should be doing. Want to learn more? Check out my free masterclass to get the inside scoop.

What's the difference between a business valuation and an appraisal?

Not much - these terms are pretty interchangeable for businesses. Both refer to estimating a business's worth with detailed calculations and reports. "Appraisal" is more commonly used for real property like equipment or real estate, but for businesses, most people say "valuation", and a few people call it a "business appraisal valuation". Either way, they mean the same thing.