32 Essential Questions to Ask When Buying a Business

Being an entrepreneur is a superpower because you have the power to expand your business to a larger extent or to overturn the misfortune of a failing venture with better strategies.

We all love making great decisions, and you know that asking the right questions before making a decision can grant you significant benefits. The same is true when buying an existing company. While it can be a complicated experience, this article highlights the questions to ask when buying a business to make this experience/your life easier!

In this article The Real Questions to Ask Before Buying a Business (Not When!) we delve into factors to consider before you ever talk to a seller, but today we're talking about the next phase.

By asking the right questions, you reduce the risk of being in a loss because you'll learn how the current/previous owner(s) ran the existing business and the revenue streams. This can help uncover red flags and hidden holes in the existing business, preventing you from losing your investment.

Either way, you can get handsome rewards for your choices if the right decisions are made. So ask the right questions and document all the responses to refer to them down the line.

TIP: By asking the below questions, put yourself in the seller's shoes and understand the existing business and their needs and demands from the transaction.

Getting started…

You've identified a venture you're interested in and started communicating with the current owner. But how do you know it's worth it? By asking the right questions, you can be confident in your decision - whether it's to continue the conversation or say goodbye.

We will dive into the questions you must ask when buying an existing business.

And there's a downloadable checklist at the end of this post with all the questions to ask when buying a business in this free guide, Ultimate Buy-Side Transaction Starter Guide. You'll get the complete list of everything to request in due diligence, a checklist of the essential questions to ask before buying a business, and the essential questions to ask when buying a business.

For those specifically interested in buying into an existing business as a partner, check out our article on Buying Into an Existing Business as a Partner.

The Initial Conversation with the Business Owner

When you're interested in buying an existing business, how much information do you need about the company and its current owner(s) to move forward? In an ideal world, the owner could tell you about opportunities they've missed and mistakes, which would be super valuable in understanding the risks and opportunities in the business.

But there isn't infinite time, and they likely won't tell you all the negative things about the business they are trying to sell. So start your conversation with these questions to understand better the company, its history, values, mission, and purpose.

How long has this business been in existence?

Knowing when and how the company started can reveal a lot about the industry, competition and potential headwinds.

Similarly, knowing how long the current owner/seller has been involved in the business is beneficial to understand their purpose - are they selling this business to retire? Buy another business? Or is there an issue with this business?

Did you create this business, or did you buy it?

Finding out about the length of continuity of the present owner could hint at the business's success, but not necessarily. It's equally as possible that an owner has grown weary of mounting losses.

If they've been successful in the firm for a long time, there's a high chance that you'll earn a lot from the business for a long while.

The purpose of starting/buying the venture is also an essential piece of information - did they want huge profits or make a difference in people's lives? This can also give you new ideas about your goals and expectations with the business.

If they bought the venture, you would want to determine how much the business purchase price was and how different the business is now than it was then. You would also like to know how the firm was started in the first place. Did it address a need? (which may speak to current market demand for the products/services) or was it created by someone's parents because the opportunity was there?

Also, don't forget to ask about their business plan to date and future.

Why are you selling the business?

Picture this: a business is going well; the company has a purpose; the business generates good revenue, so why are they selling?

There are two possible outcomes here, either:

a) the business is thriving, and they want to achieve a payout because they want to retire or do something else like start a new business, or due to personal circumstances or

b) there are obstacles that the current owner doesn't want to tackle.

This information can help you decide whether you want to continue the conversation or walk away.

A Chat About the Insides of the Existing Business

Now that you've become familiar with the owner(s)/founder(s) and the purpose of the business, it's time to talk about the inner workings of the business. The depth of the seller's responses will change throughout the process as you sign a nondisclosure agreement (NDA) and proceed through the various rounds. Still, by the time you enter into a transaction, you need the answers to these questions.

How does the business generate money?

Who are the business's existing customers?

What other revenue streams does the business have?

You likely know how the business earns its revenue in general, but do you know all the income streams and what percentage of the total each represents? There might be sources of income that you don't know about as an outsider, so it's an excellent question to ask.

If you have the opportunity to get a list of existing clients, don't miss it! This information will likely come at a later stage of negotiations because sellers will keep this information close. At earlier stages, you can ask for an anonymized list of revenue for the top 10 customers (Customer A, Customer B, Customer C etc.)

Suppose the business has long-term or continuous profitable clients. In that case, it's a massive plus because you will most likely still have these significant clients after buying the business, so it's a constant income from day 1! On the flip side, having only a few customers is a risk because it may negatively impact revenue if you lose one.

On that anonymized list, have the seller note the number of years they have been a key customer. Again, this might be sensitive information, so a range of years (say 1 to 2 years or 5 to 10 years etc.) is a good starting point.

It's also a good idea to ask about other revenue streams of the business - do they have interests in other subsidiaries or ventures where they earn a percentage from the profits? It's going to be yours after the deal, so you need to nail down all sources of income (continuing or not). If there are non-continuing streams of income, you want to know how much of the historical income it was so that you can adjust the historical financial statements accordingly when determining the price.

What are the marketing strategies of the business?

Whether it's a new business venture or an online business, the marketing strategy plays a huge role in brand recognition and maintaining the company's reputation. Ask the owner(s) about what they have done for marketing in the past. Ask about their social media accounts and if they drive sales or rely on a business development/sales team. What worked and didn't work can help you decipher what drives sales and learn from others' mistakes.

Learn from the mistakes of others. You can't live long enough to make them yourself.

Eleanor Roosevelt

What is the current market like? Are there potential opportunities that you've missed & what stopped you from tapping into those opportunities?

While you might have done your research on the current and target market, industry and trends, it's a good idea to hear the perspective of the existing owner too.

Worthwhile opportunities are rare, and preparation is vital, so asking the owner about any missed opportunities can help you prepare yourself with the required resources to grow the business to grab existing and upcoming opportunities.

Who are the business's significant competitors? What are they doing differently? What makes your business stand out?

Maintaining and growing the firm's products or services offering is key to any successful organization. However, being better than your competitors is essential. And knowing your competition is crucial! So, find out who the business' competition is and why/how they're different. Ask the owner how their company is better and preferred than their competition. This can give you ideas to improve the business and collaborate with others to beat the competition. Also, gauge the firm's weaknesses compared to its competitors to assess the risks of the competitive landscape.

If everyone is moving forward together, then success takes care of itself.

Henry Ford

Who are their suppliers & vendors?

Suppliers and vendors are essential external stakeholders of a firm.

For example, if a vendor can supply locally and not nationally, you might need to look for more vendors if you decide to grow the firm on a national level. You want to make sure you can continue using the same suppliers at the same prices after a transition. And if not, are there substitutes for the current suppliers? Or are there a couple of specific suppliers where there are no alternatives? All else being equal, the greater the number of suppliers, the lower the risk.

What are the business's expenses?

Knowing where the money goes from the company is vital because if costs can be reduced, this means more resources you can reinvest in the organization for research, development and expansion—alternatively, higher profits in your jeans. So you'll need to take a deep dive into the business's expenses.

Tell me about your role in day-to-day operations?

Sometimes running a business isn't just about the idea but also the skills. Each business has different skills that the owner needs to have. Mainly, you want to ask this because you want to know if you can step into their shoes, you want to know how reliant the business is on the owner's day to day involvement, and you want to know how many hours a week on average they work in the organization.

What are the management team's critical skills to run this business successfully?

Whether it's a small business administration or large, a significant part of business acquisition is identifying risks and opportunities for its success. Ask the owner about the skills that are essential in running the venture. Are these skills you have, can hire or can quickly get up to speed? It's also important to know the employee expertise required to be part of the team to deal with multiple suppliers and existing contracts and make the business successful.

The future belongs to those who learn more skills and combine them in creative ways.

Robert Greene

Who are the key employees, and do they intend to stay?

A business is successful because of the forward-thinking management team and loyal employees. As a new owner, you'll have to focus on retaining the loyalty of essential employees like CFOs, team leaders, department heads, managers and supervisors. Finding out if the existing employees intend to stay under your management is vital for the success of your business operations. If they don't plan to stay, the price you are willing to pay for the entity may decrease.

How well documented are the procedures?

Every business has a process, whether it's a courier company, restaurant, or multinational company. Knowing there are defined processes in place can smooth the transition of ownership of the business with minimal disruption to the routine of work. However, the processes must be well-documented for the new owner to review. These can also be useful if a new employee has to replace a departing employee.

All in all, a company with well-documented procedures is a company under good management and a company that you are more likely able to operate successfully after a transition.

The Financial Conversation & Balance Sheets

You've got a picture painted about the venture, and you know about the why, who and how of the business, but before you make the final decision whether you want to invest in this company or not, it's time; to talk about money! The seller will have provided you with a high-level summary of the financials for you to assess an offer.

If you have a financial advisor, at some point in the due diligence process, you will coordinate with the business owner to access the company's finances, financial statements and tax returns for the past few years.

What are the annual gross revenue and profit margins?

If you're buying a new venture, you want to ensure that your investment doesn't go down the drain. Knowing the annual gross revenue and profit margin can help you determine this transaction's Return on Investment (ROI).

How much working capital does the company have?

Knowing the company's required working capital is essential to determine how much cash you will need to invest in capital for day-to-day operations.

What's included in the sale?

Now that you've got the finances sorted. The next step is to know what's included in the business beyond the obvious assets.

What assets or liabilities on the balance sheets are included in the sale?

Are you offering any support?

Are you willing to accept non-competition clauses?

Ask about possible red flag issues.

Are there any pending lawsuits, legal obligations or issues?

Will I have any liability?

Passing the ball around…

By now, you know about the company's mission, vision, and purpose, as well as the internal and financial affairs. Now it's time to get into the details of the price!

At this moment, you have to ask the owner about their deal, ask them why they think their price is fair and negotiate. Remember to be firm and confident! Here are 7 questions to get you started on this:

How much are you asking?

Tell me the value of goodwill in your business?

How did you determine the sales price?

Has an external advisor evaluated your asking price?

Are you willing to negotiate?

Are you looking for an all-cash deal?

Are you open to seller financing?

Deal or No Deal

You know about the business and the price of acquiring it. But is it worth it? The current owner thinks so, but how can you be sure that it is worth this price?

In such situations, most people choose one of the following options:

They evaluate the pros and cons of buying the company and decide based on feel.

They hire an experienced business valuator or business broker to evaluate the firm for them. The M&A advisor charges you a fee, which could be fixed or a percentage of the transaction value.

They follow The Valuation Formula, the step-by-step course that teaches the one formula you need and the insider strategies to negotiate the best price for a business course.

To find out more about The Valuation Formula, check out our free masterclass: How to Value a Business and Negotiate the Best Price ...Without Complex Excel Models, a Degree in Finance or Access to an Investment Banker.

Proposed Transaction for the Business Venture

Once you've got your business valuation, you make an offer and/or negotiate with the owner. If things go well and you and the other party shake hands on the deal - but it's not over yet!

Do you know what information you should request before purchasing a business?

You'll need access to all the essential documents, like current cash flow statements, income statements, tax returns and the company's current contracts. For a complete list of items to request during due diligence, download the Ultimate Buy-Side Transaction Starter Guide. You'll get the full list of everything to request in diligence, a checklist of the essential questions to ask before buying a business, and the essential questions to ask when buying a business.

Frequently Asked Questions…

You're not alone. There have been many individuals just like you, in the past and present, in the process of buying an existing business. They've all had common questions.

What are the key questions to ask when buying a business?

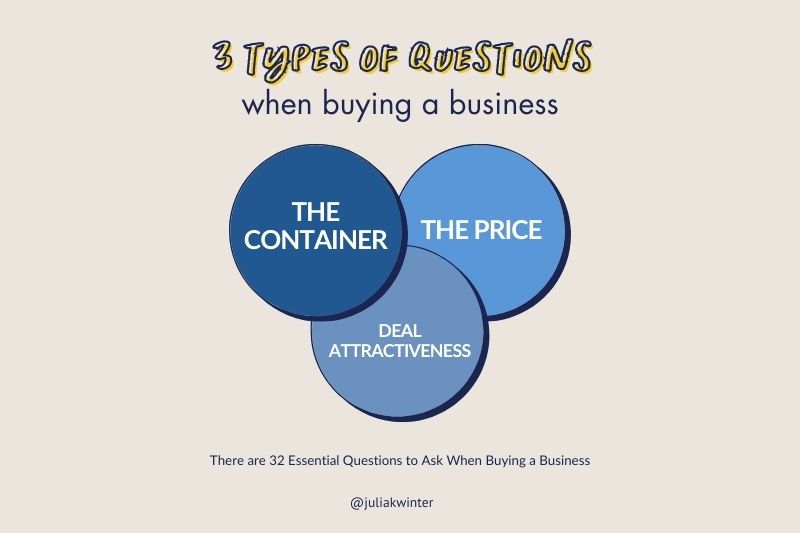

Many of the best questions to ask when buying are covered above, and the key considerations come down to questions that help you determine: the container, the price, and deal attractiveness.

First, you need to define the container of what you're buying so that you can determine the price. What assets are included versus excluded, is real estate included or not, what key employees can you expect will stay with the firm, is there any intellectual property, can you expect the same cost structure in the future, customer relationships etc. Your first job is to nail down what that container looks like.

Once you've defined the container, your job is to determine the price. You've nailed down the components of expected working capital, and now you can calculate it and assess the risk of achieving that cash flow. Cash flow and risk determine the price you're willing to pay.

I've developed an easy 4 step formula called The Valuation Formula to help aspiring business owners determine the value of a business and negotiate the best price. You can learn more about the formula in my free masterclass How to Value a Business and Negotiate the Best Price ...Without Complex Excel Models, a Degree in Finance or Access to an Investment Banker.

And finally, questions about deal attractiveness forces you to put on your investor's hat and not be too tied to the opportunity in front of you. Sometimes buyers can become enthralled by a particular business and ruminate on all the time spent to date investigating a specific company. They lose sight of the overall attractiveness of the deal. Don't forget that you have other alternatives for your capital. A deal has to make sense, from the final purchase price to the cash flow risk and any potential headwinds identified in the exploratory stage.

What do buyers look for when buying a business?

Keeping with the 3 key areas of focus: container, price and deal attractiveness, buyers should look for an opportunity that satisfies their goals in all three areas. And take a step back and look for an opportunity that fits your personal goals. How does buying this business fit your investment thesis, timeline and end goal?

What financial questions are ok to ask when buying a business, and when do I ask them?

You can ask whatever you want but be prepared that the seller won't necessarily answer them all at earlier stages. Private businesses are private and won't reveal all their secret sauce. It's a balancing act between providing enough information to get a deal done and not giving away all your data to all interested parties.

Summary…

In this article, we've discussed the power of asking the right questions. The questions highlighted help you rethink if the business you've found is worth it. Taking clear notes about the answers to the questions can help you make the right decision. This will help you negotiate the right price without paying more than the venture is worth.

Next Steps

Grab the checklist with all the questions to ask when buying a biz in this free guide, Ultimate Buy-Side Transaction Starter Guide.

You'll get the complete list of everything to request in due diligence, a checklist of the essential questions to ask before buying a business, and the essential questions to ask when buying a business.